Macromegas #49 - Russia, Ukraine, Wheat & Global Food Security

With the invasion of Ukraine, Putin is cornering global wheat exports and threatening global food security

We've all heard of Europe's dependence on Russian gas imports.

Everyone following what is happening in Ukraine is aware of the dilemma caused by Europe's dependence on Russian gas imports.

This dependence could have been prevented if European countries such as Germany had not halted their civil nuclear programs, thereby both crippling their own energy independence and letting their carbon footprint balloon.

But even before energy, the world depends on food.

Roman Emperors leveraged Egypt - and Sardinia - to control up to half the global population of the time.

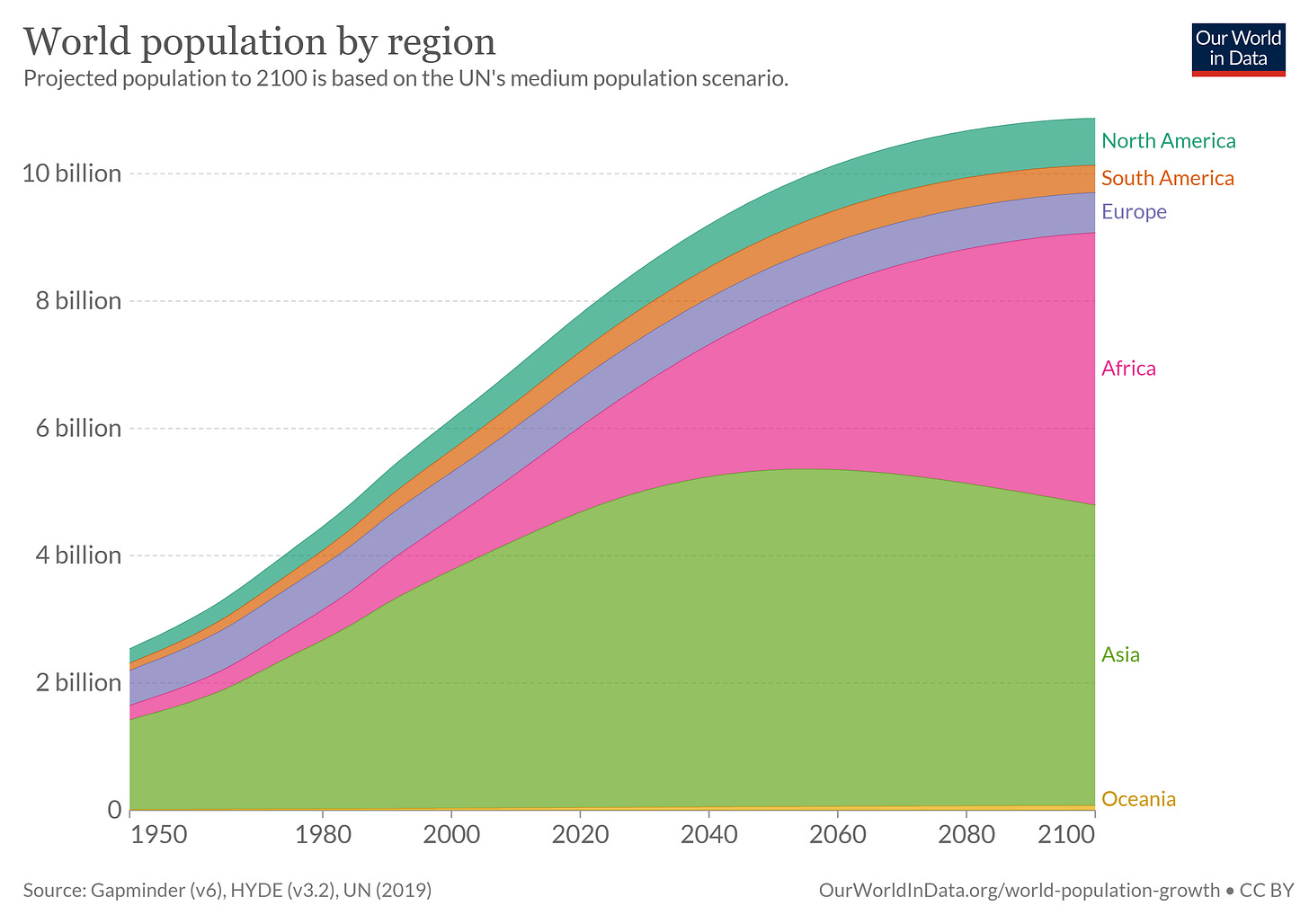

The fast-growing global population and climate change are making that problem even worse.

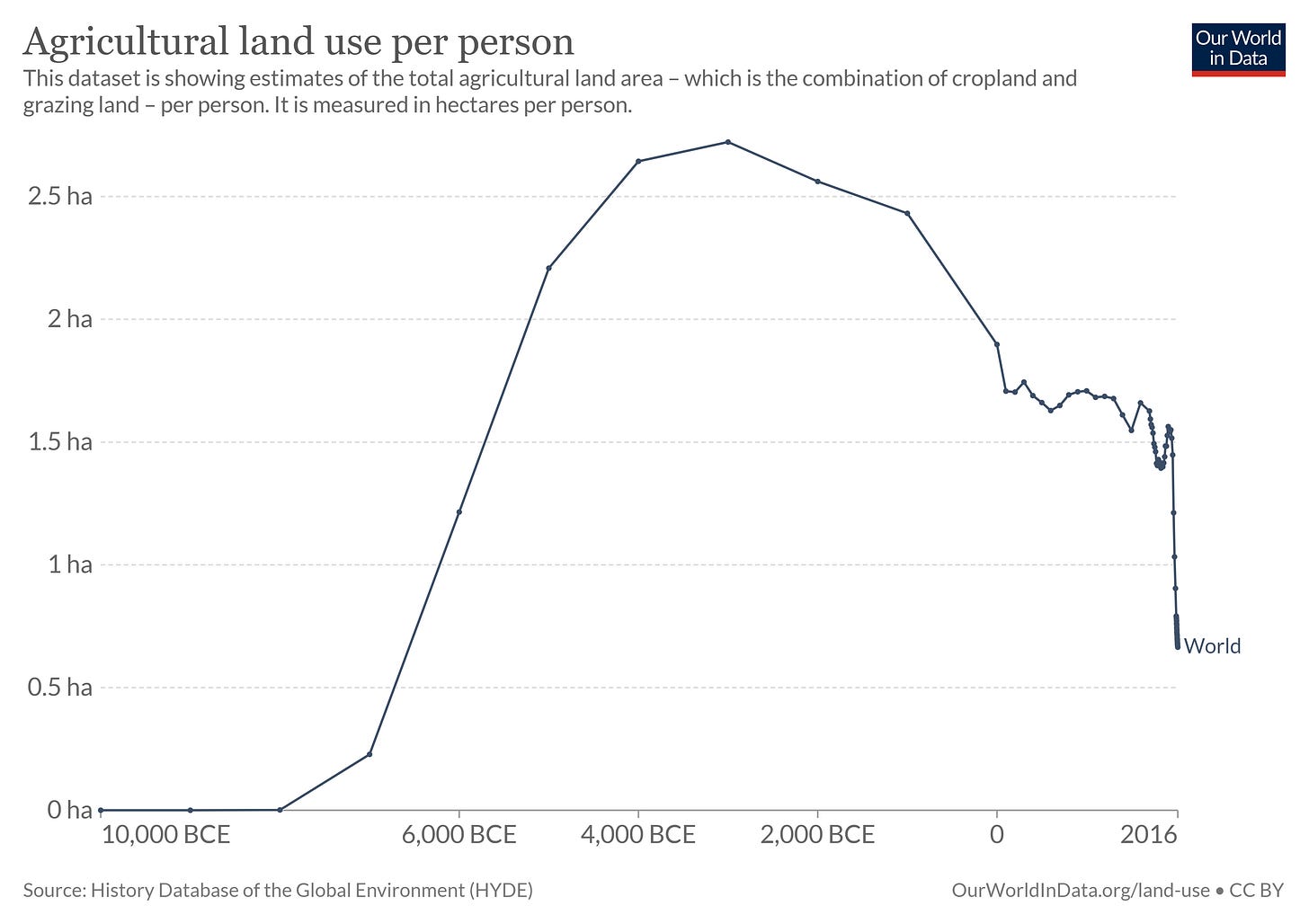

The world has to feed its population on a constantly shrinking agricultural area per capita.

Some countries are more challenged than others, and many have already reached their limits.

Most of the world's population still gets most of its energy intake from cereals.

High-income countries enjoy a more diversified diet, but low- & middle-income populations' diets are based on cereals, from 50% to as high as 80%.

On average, globally, 80%+ of cereal consumption is shared about 50/50 between rice and wheat.

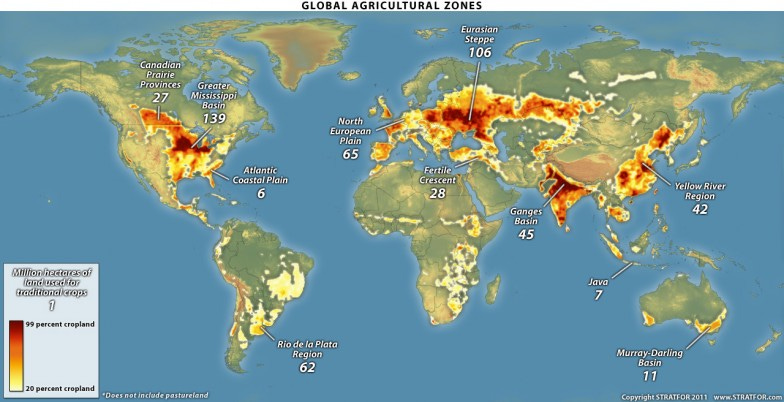

The "Russian" - and Eastern European - plains are the second largest agricultural region globally.

It happens that the Eurasian plains are the second largest agricultural region globally, after the Mississippi basin. Far before the 3rd and beyond.

Their fertility cannot easily be artificially reproduced anywhere else: it is a given from a geopolitical perspective.

Beyond its incredible cereal production potential in absolute value, this region is not as densely populated as the other agricultural basins.

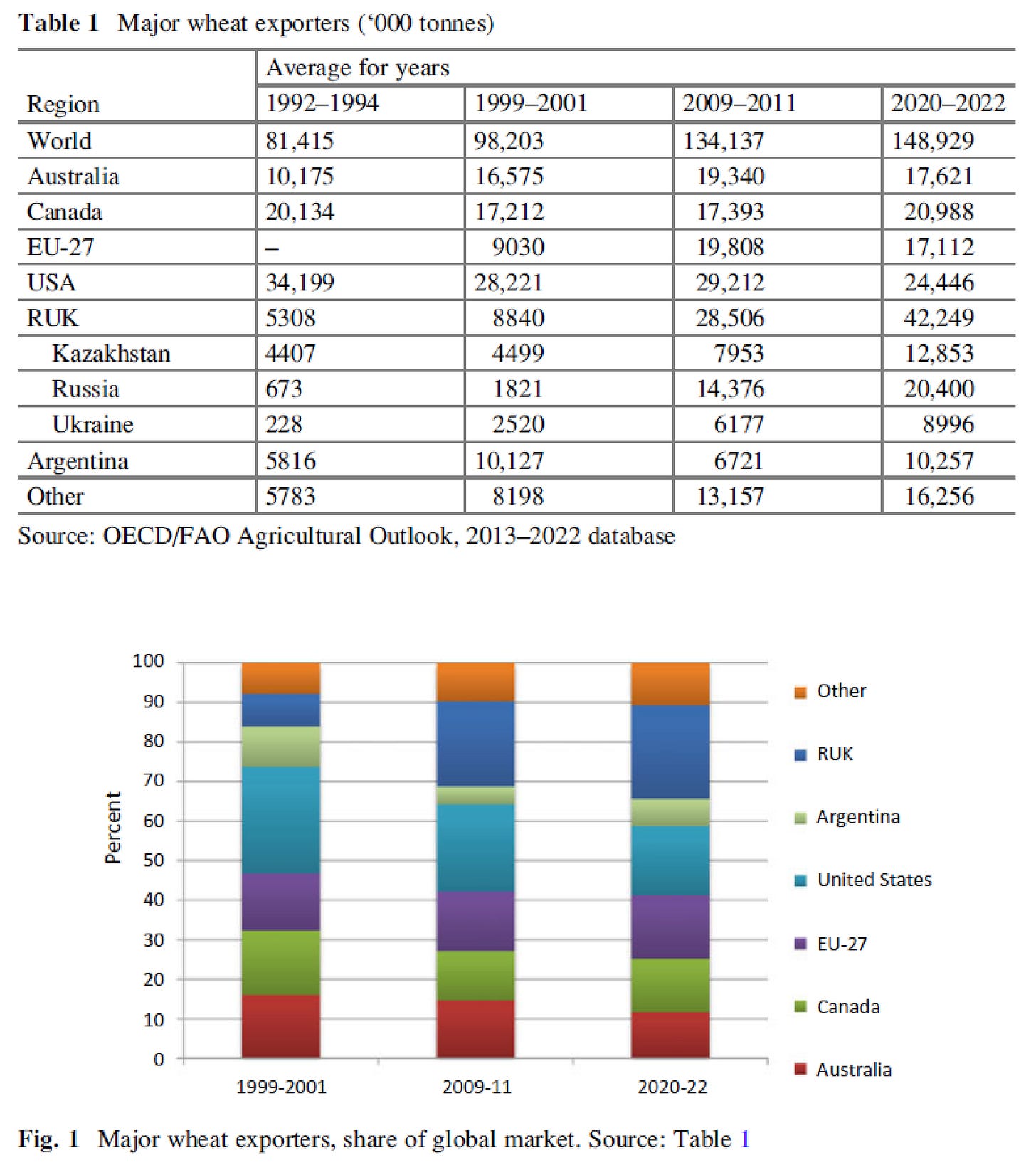

This is why Russia and Ukraine collectively represent 25%+ of global wheat exports.

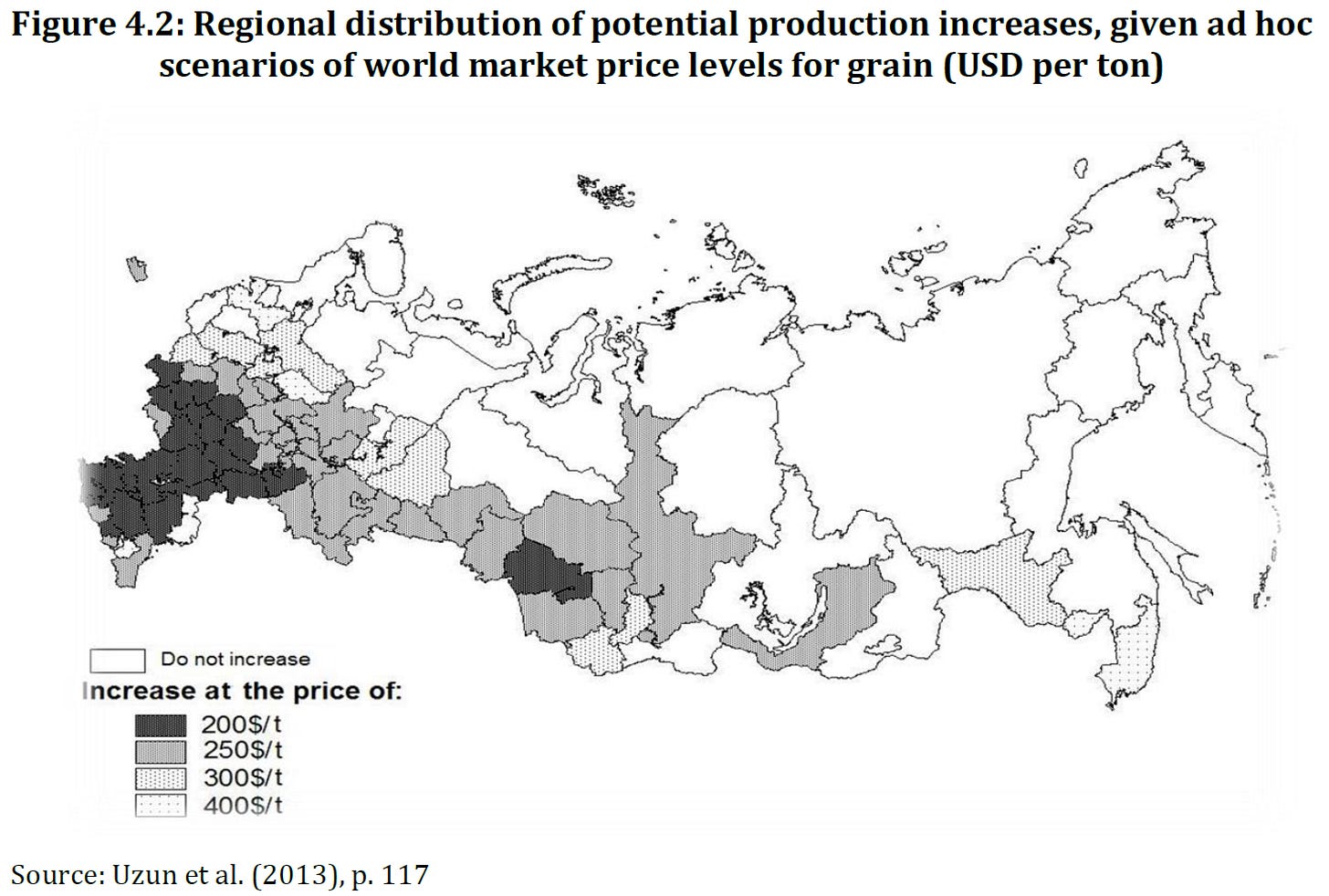

Because yield is still much lower than in other regions (and because their populations are not growing much), Russia & Ukraine (CIS on the chart) still have tremendous potential to increase their share of global wheat exports.

And they are already doing so.

Russia also has the optionality to increase cultivated area since it currently controls about 25% of all arable lands globally. The only barrier to this increase is profitability depending on world market price.

It is worth noting that ~40% of all wheat consumed globally is exported (based on 70kg annual consumption per capita and a $200 price per ton). Thus we are not talking of marginal exports vs. largely self-sufficient countries, but rather some excedent countries feeding large chunks of the world.

This allows Russia - and Ukraine - to literally feed the world.

At an average 70kg average of annual wheat consumption per capita, an average weight of 40% for wheat in the global cereal consumption mix, and an average world market price of $200 per ton of wheat, Russia & Ukraine's combined wheat exports feed 300,000,000+ people globally. Not even including their large exports in corn and other cereals. 4% of the world.

And considering their agricultural potential vs. world population growth, they might be feeding twice that share in a decade or two.

Most of this wheat-exports-dependent population lives in climate challenged (Africa, Middle-East) or space-constrained (South-Asia) regions.

Most of those countries are low-/middle-income, and some are very dependent on those cornered wheat exports.

Egypt

Turkey

Bangladesh

Nigeria

Indonesia

Their combined population also represents a large and growing share of the global population (10%+ and growing).

Naturally, due to their fast-growing population and limited agricultural potential, their demand for Russian & Ukrainian wheat is exploding.

Russian Wheat

Ukrainian Wheat